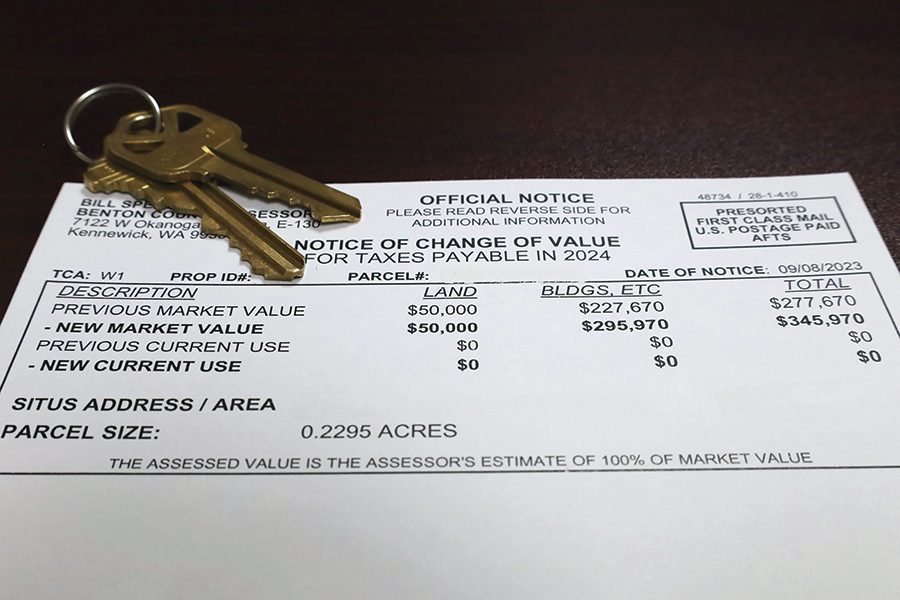

If you’ve recently received your property tax assessment in Washington State and felt a jolt of sticker shock—you’re not alone. Many homeowners across King, Pierce, and Snohomish Counties are asking:

“Why is my assessed value higher than what homes are actually selling for?”

This blog post breaks it all down—what property taxes in Washington are based on, why assessments can feel out of sync with market trends, and what you can do if you disagree with your appraisal.

🔍 What Are Property Taxes Based On in Washington?

Washington State calculates property taxes primarily based on your home’s assessed value, which is determined by your county assessor. The key components:

| Term | What It Means |

|---|---|

| Assessed Value | What the county believes your home is worth, as of January 1st of the previous year |

| Market Value | What a buyer would reasonably pay for your home today |

| Taxable Value | Often the same as assessed value, unless exemptions apply (senior, disabled, etc.) |

Important: Your property taxes are NOT directly tied to the price you bought or sold the home for. They’re based on the county’s mass appraisal model, which may lag behind or overshoot the real-time market.

📈 Why Are Assessed Values Higher Than Sale Prices in 2025?

Several reasons explain this disconnect:

1. Appraisals Are Lagging & Use Mass Models

County assessors use mass appraisal techniques, averaging data from prior sales in a geographic area. Because Washington uses January 1 of the previous year as the valuation date, your 2025 tax bill is based on market conditions in early 2024—when prices were hotter.

📊 Example: If your King County home is assessed at $850,000 based on Jan 2024 data, but the current 2025 market value is closer to $800,000, your tax bill won’t reflect that decline until at least 2026.

2. Washington’s 1% Rule is a Ceiling, Not a Cap

The Washington State Constitution limits regular property taxes to 1% of the assessed value (known as the “1% constitutional limit”). But:

- Voter-approved levies (schools, parks, EMS, etc.) often push the total tax rate to 1.1–1.3% of assessed value.

- Some taxing districts may increase taxes by 1% per year, regardless of property value changes.

3. Home Improvements Raise Assessed Value

Added a new deck, remodel, or ADU? Even if your home’s market value didn’t rise much, these updates get reported to the assessor and may increase your assessed value disproportionately.

4. Limited Appeal Awareness

Many homeowners aren’t aware they can appeal an assessed value if it’s too high. Counties assume values are accurate unless challenged—and appeals must be filed within 30–60 days of the assessment notice.

💡 What You Can Do About a High Assessed Value

If you think your property has been over-assessed, you can take action:

✅ Step 1: Compare to Local Sales

Look at comparable properties (comps) sold within the last 6–12 months in your neighborhood.

✅ Step 2: File an Appeal with Your County

Each county has a Board of Equalization:

- King County: kingcounty.gov/appeals

- Pierce County: piercecountywa.gov/boe

- Snohomish County: snohomishcountywa.gov/134/Board-of-Equalization

You’ll need:

- A copy of your assessment

- Sales data or a professional appraisal showing lower value

- Proof of condition (photos, inspection report if applicable)

Note: You are appealing the value, not the tax amount. Your success depends on showing that the assessed value exceeds market reality.

🏡 Why This Matters Now

In 2025, many areas of Washington have seen softening or plateauing prices, but assessed values are still catching upto the downturn. Homeowners feeling the pinch from rising mortgage costs, insurance, and utilities are especially concerned with over-taxation.

Understanding how the property tax system works—and pushing back when necessary—can help ensure you’re not paying more than your fair share.

📬 Final Thoughts

Your tax assessment isn’t just paperwork—it’s a key piece of your home’s financial picture. If your home’s assessed value feels inflated in today’s cooling market, take the time to review your options and consider filing an appeal.

If you’d like help pulling comparables or navigating the appeal process, I’d be happy to assist.

📩 Let’s connect — you shouldn’t have to pay more than you owe.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link